What is a Form 1098, and why am I receiving it

If you itemize deductions, you can use the information from Form 1098 to claim a deduction for mortgage interest paid; that appears on Schedule A of your Form 1040 tax return. You may deduct the interest on your mortgage, points you paid for certain home purchases,

If you itemize deductions, you can use the information from Form 1098 to claim a deduction for mortgage interest paid; that appears on Schedule A of your Form 1040 tax return. You may deduct the interest on your mortgage, points you paid for certain home purchases,

Although the interest paid on a mortgage for a second home can be claimed as a deduction, this is only allowed if the home qualifies, under IRS rules, as a "qualified residence." You should receive a separate Form 1098 for each additional home mortgage you have. Provided you qualify for mortgage interest deductions on primary and secondary residences, you'll be allowed to include interest paid on both primary and secondary residences. Since there's a limit on the aggregate amount of mortgage debt eligible for deduction, it would also be helpful to refer to the rules, as provided by the IRS or a tax professional, for more information.

Although the interest paid on a mortgage for a second home can be claimed as a deduction, this is only allowed if the home qualifies, under IRS rules, as a "qualified residence." You should receive a separate Form 1098 for each additional home mortgage you have. Provided you qualify for mortgage interest deductions on primary and secondary residences, you'll be allowed to include interest paid on both primary and secondary residences. Since there's a limit on the aggregate amount of mortgage debt eligible for deduction, it would also be helpful to refer to the rules, as provided by the IRS or a tax professional, for more information.

If the amount of interest you received was less than $10, then the institution does not have to send you a 1099-INT. However, even if the amount is a tiny one, you still have to include on your tax return any interest income you received.

Just think of this as an interest income report, and you can use this 1099-INT to report interest income when submitting your tax return.

Typically, there should be a specialized section within tax forms for reporting interest income.

Here are several options available for you: either you file it yourself or tax software takes you through the process.Here are several options available for you: either you file it yourself or tax software takes you through the process.

If you find errors on your 1099-INT Form, you should contact the issuing institution promptly and ask for a correction.

They will then make the correction and mail the corrected form to you and to the Internal Revenue Service.

If you found some errors in your Form 1098, be it mortgage interest amount or principal balance and others

Since there's a limit on the aggregate amount of mortgage debt eligible for deduction, it would also be helpful to refer to the rules, as provided by the IRS or a tax professional, for more information.

If you itemize deductions, you can use the information from Form 1098 to claim a deduction for mortgage interest paid; that appears on Schedule A of your Form 1040 tax return. You may deduct the interest on your mortgage, points you paid for certain home purchases, and mortgage insurance premiums-out subject to some conditions. Compare what your lender has put on Form 1098 you receive to the information below, and for specific information, check the guidance of the IRS or speak to a tax professional.

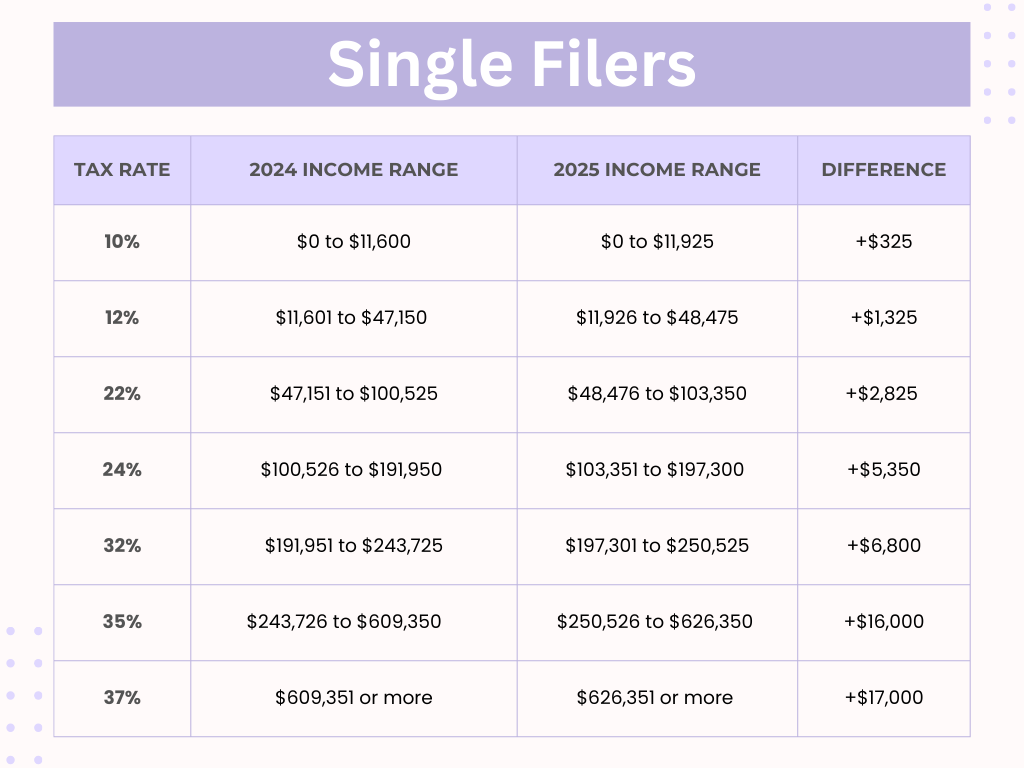

TAX COMPARISION 2024-2025

| 5416 | 654 | 654 | 654 |

| uy | ig | uih | yg |

| fuy | vh | h | f5 |

| 58 | 564 | 54 | 14 |

| 584 | ui | nj | bkj |

| bh | bj | 544 | 564 |

| 4 | 564 | 564 | 84 |